Credit Card Travel Hacking for Beginners

This post might contain affiliate links. That means I may earn a small commission at no extra cost to you, if you buy through my site. I appreciate your support of my site.

I’m constantly asked how I can afford full-time travel. The answer could fill an entire post, but you will have to anxiously await that post. For now I will let you in on one of the best ways to afford full-time travel, travel hacking! I will show you how to travel hack without spending any more than you usually would.

While this post has been at the back of my mind for a long time, I realized it was my duty to get you started on credit card travel hacking for beginners. It hurts a little to give away all my secrets, but I want to share the joy of saving hundreds if not thousands every year from travel hacking. Don’t worry you can support me by Buying Me a Coffee to thank me for all the money you’re about to save!

What is Travel Hacking?

Travel Hacking is the art and skill of saving money on your travels. Some people get it confused with travel tips, things like how to pack efficiently or how to navigate customs.

Travel Hacking is only focused on the monetary aspects of traveling, such as earning free nights at a hotel or free flights. The main currency is miles and points. The goal is to earn miles or points and then redeem them for free travel.

As I travel full-time, everything I do is considered travel. Even if I earn cash back on a retail shopping purchase that cash back could be put to travel. Therefore I am including several strategies that will help you save money on fun activities at “home” too!

Who Can Travel Hack?

Anyone who pays their bills on time and in full can travel hack! This post is focused on credit card travel hacking. You never want to sign up for new cards and/or use cards if you can’t pay your balance in full. If you are in debt or would go into debt doing these strategies, you are not doing the strategies correctly!! You need to get out of debt and to a place where you pay your bills on time and in full, before considering travel hacking.

What many people don’t understand is that travel hacking makes full-time travel much cheaper than living a traditional life in a stationary home.

Another misconception is that you can only travel hack if you travel full-time and won’t earn enough to make it worth it unless you are traveling really frequently. I’m here to tell you that travel hacking is the golden ticket whether you are a fellow digital nomad or are simply enjoying the city you live in.

Why Travel Hack?

If you are asking this question you need to scroll up and re-read about travel hacking! Who doesn’t like to save money? It always boggles my mind when people CHOOSE not to save money. Again I want to make it very clear, travel hacking is not going into debt! It’s not doing things you wouldn’t otherwise do. It’s staying at the same hotel, but earning points that later turn into a free night. It’s getting cash back at a restaurant where you were already eating.

Several people, unbeknownst to them, inspired me to write this post. While a friend complained that she needs to save money and can’t go out to eat often, she also wasn’t interested in a free app that offers cash back at restaurants. Another friend paid $80 more than me for the same theater ticket.

Credit Card Travel Hacking for Beginners

Step 1: Decide Your Goal(s)

The goal of credit card travel hacking is of course to save money, but it’s also to get nicer and more experiences than you could if you were paying in cash.

You want to keep your goal(s) in mind when beginning to travel hack so you don’t end up spending more than you wanted to or have your points/miles spread so thin that they aren’t worth anything.

You’ll want to consider your lifestyle and future travel plans. If you live in a Delta hub, it probably won’t make sense to sign up for an American Airlines credit card. A night at a Hyatt property with an amazing promotion may not be worth it if it means losing out on a night at a Marriott where you could move to the next status level.

Perhaps you have a honeymoon in mind or a family trip to a particular destination. You’ll want to keep that in mind when you choose what credit card(s) to use and how to earn, transfer, and redeem points.

Step 2: Sign-Up for a Credit Card

The heart and soul of travel hacking is using credit cards. There is not a lot of travel hacking you can do without one. You don’t need a specific “travel” card to be able to travel hack, but it will benefit you a lot more if you travel frequently.

Once you know your goal(s) you will have a better idea of what credit card to sign up for. If you are dreaming of a stay at a Hyatt all-inclusive resort you may want to sign up for the Hyatt card. If you frequently fly Delta, then you may opt for a Delta card. The Bilt Mastercard is great for those of you that pay rent. If I was living in an apartment and paying rent I wouldn’t hesitate to sign up for this card!

Unless you have a very specific plan, you will most likely want to sign-up for a general travel card that isn’t tied to a particular brand. The Chase Sapphire Reserve and the Venture X are both popular choices. Then you will be able to book travel within the card’s online points portal as well as transfer points to other travel partners.

As a full-time traveler the Chase Sapphire Reserve is my favorite card. The high annual fee of $550 is nothing compared to how much I earn in a year. In my Chase Sapphire Reserve post I shared what I earned in my first year of using the card. That was as a newbie before I really divided into the world of miles and points!

Step 3: Use Your Credit Card(s)

What is the point of a credit card if you don’t use it? After making the minimum spend many cards offer big sign-up bonuses. They can go a long way towards an expensive trip. Time your credit card sign-up when you will be able to meet the required spend in the stated time.

After you receive the sign-up bonus, continue using your card. When you pay $20 in cash that is $20 down the drain. When you pay $20 with a card you will be receiving points. There are plenty of opportunities (described below) that you also earn additional cash back or points. Using a credit card is essentially receiving a small discount on every purchase. Snagging additional deals and offers, gives you even more of a “discount”.

Plus there are many other benefits to holding cards which can include free lounge access, food delivery memberships, global entry, and rideshare memberships. Read all about the benefits of the Chase Sapphire Reserve.

Step 4: Sign-Up for Travel Memberships

Airline and hotel memberships offer free sign-ups. Before staying at a hotel or flying an airline, join their loyalty program. Stay up to date about any promotions or offers and plan your stays and flights accordingly. You want to redeem as many points as possible, for as little cost as possible.

The number of brands you sign up for should be in proportion to how much you use them. Don’t spread yourself too thin or you won’t be able to gain status at any one brand. With “status” you receive more points per dollar spent and other perks that may include free breakfast, room (or seat) upgrades, lounge access, and late check-out.

Step 5: Link Loyalty Accounts for Additional Points

For every flight you take and every hotel stay you will receive points. With higher status you will receive more points for the same amount you paid. With a branded credit card for that hotel or airline you will receive even more points.

You can earn points without even staying at the property or flying the airline, by linking your loyalty accounts. Many of the following companies give you a choice of which travel partner you would like to link. Whenever you make a purchase with that company you earn points towards the loyalty account you chose.

Sometimes the brands have special promotions with bonus points for linking your accounts. Once accounts are linked, the points come rolling in automatically!

Rideshares

For every dollar spent on Lyft you receive 2 points on Delta, Hilton, Alaska Airlines, or Bilt.

Uber and Marriott have a partnership where for every dollar on Uber rides and Uber Eats you receive 2 points. When receiving food delivery to a Marriott property you receive 6 points. Sadly it is only valid in the US.

Rental Cars

Hertz has a whole slew of travel partners, both airlines and hotels. The points vary based on the partner. For every Hertz rental you can receive 500 Marriott bonus points. When using other car rental companies check to see if they have any travel partners before booking.

Dining

Most of the US hotels and airlines have a dining program where you connect your card and any restaurant in their system earns you points for dining there. The restaurants are typically the same between different programs.

You can connect any card to any program, but you can only connect to one program per card. For example, Eat Around Town, the Marriott program, I can have my Delta card connected to it, but then I can’t have my Delta card connected to SkyMiles Dining, the Delta program.

There is usually a sign up bonus. Initially make sure to eat at the required number of restaurants to earn the bonus. For Atlanta restaurants I have a list of all the restaurants included. After the initial bonus period I don’t plan to go to a restaurant because of the offer, but if I do then I am happy to receive the extra points! For any non-planners you don’t need to figure it out. You’ll automatically receive the points after your dine at one of the restaurants.

Step 6: Use Other Reward Programs

Booking.Com

While I recommend being loyal to one or two hotel brands, if you don’t travel frequently it will be harder to accumulate points. Often properties at brands like Marriott, Hilton, Hyatt, and IHG are a lot more expensive than other local accommodations.

In situations where it isn’t worth it for you to become loyal to a brand, the big brands are much more expensive, or they are not available, you’ll want to use a travel accommodation aggregator (searches across all the available hotels).

Booking.com is my preferred choice. With Booking you’ll be able to search by map view to see properties nearby on a last-minute road-trip booking. You can also score “secret deals” for really nice properties. Just like hotel brands have status levels, so does Booking. The more you use Booking, the more you save as your Genius level will go up. You’ll often be given perks like upgraded rooms, lower prices, or breakfast included.

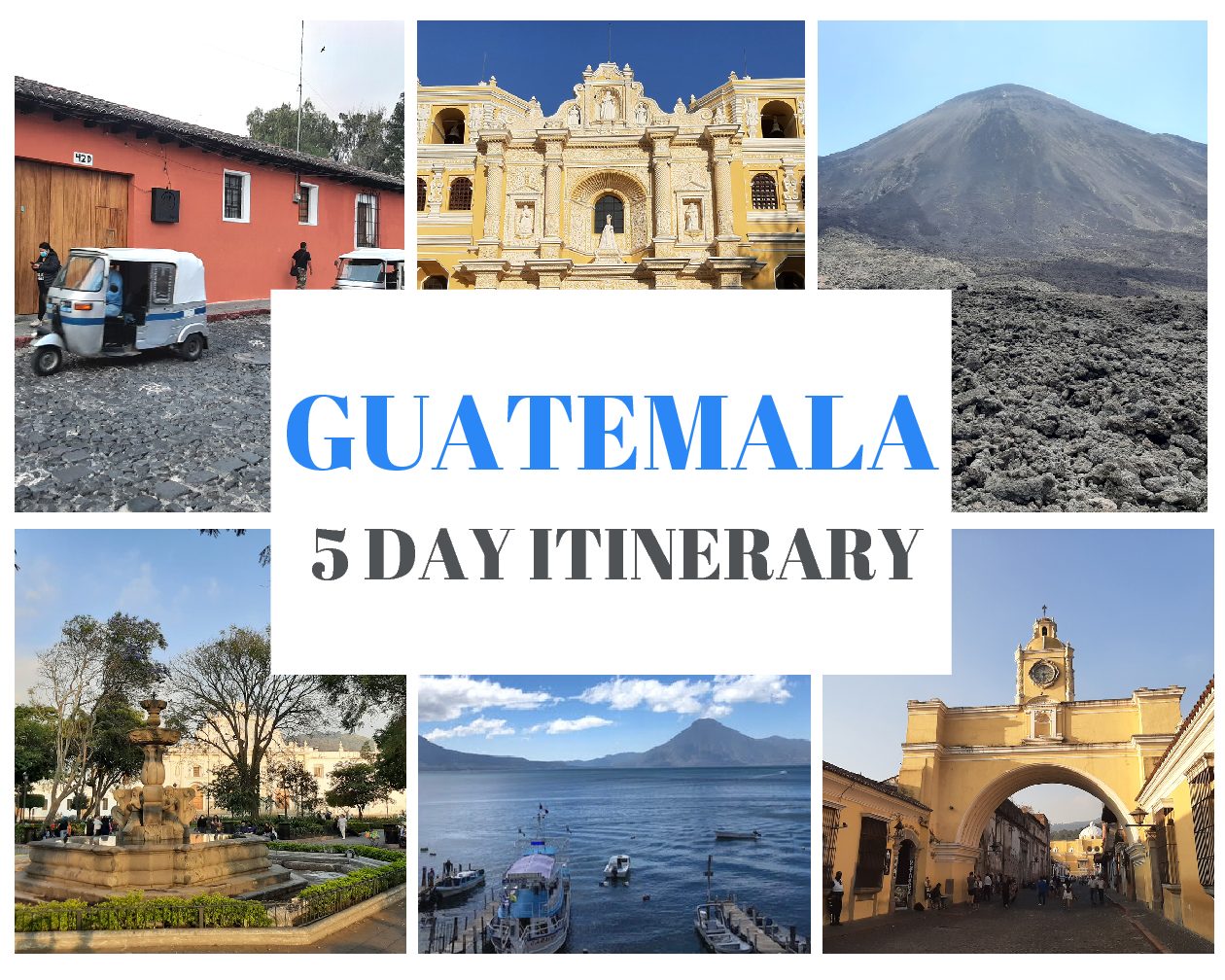

During my Guatemala trip, I stayed in small cities and towns where there wasn’t a brand hotel anywhere to be found. Booking is great for showing you what’s available, giving you the best price, and ensuring support if there are any issues. The reviews can be trusted as well, because unlike TripAdvisor or Google, only people who booked can leave a review.

AirBnB used to be the go to for furnished short-term rentals. Now Booking.com has apartments as well, but without all the insane costs as AirBNB. I have found and booked the same place that is also on AirBNB, but for hundreds of dollars less.

Bilt Rewards

As I mentioned above, Bilt has their own credit card. As I don’t pay rent, at least in the typical sense, it isn’t the most beneficial card for me. The Bilt rewards program is open to everyone and free to join.

Without a Bilt credit card I still earn points in various ways and gain other perks. The first of the month there are always extra deals. Last month with a click of a button I received free World of Hyatt Explorist status for 3 months (with the option to keep or upgrade the status).

Lucky Seat

There are so many ways to buy discount tickets on Broadway. Lucky Seat isn’t a rewards program, but it does sell discount tickets for Broadway shows across the US. Almost any city that has a touring Broadway show will have tickets available on Lucky Seat. The tickets are lottery tickets, so you aren’t guaranteed seats or seats for a particular date.

The lottery works great if you have some flexibility! Exact seats are given when you pick up your tickets before a show. Pairs may be separated and it’s possible to get partial view seats. Knock on wood, that has never happened to me. Typically I receive center orchestra seats. For $10 a ticket I received front row Hamilton seats!

Step 7: Sign-Up for Cash Back

While cash back from credit cards isn’t always the best option (see step 8 below). Cash back apps and sites are very helpful. What’s so great about the following apps/sites is that you pay for the purchase in full. Then you receive your credit card points for the total purchase.

Once the purchase has cleared you will receive cash back in your account that can be sent directly to your bank account (or redeemed for a gift card). This is essentially income, but the IRS doesn’t treat it as income so it is tax-free!

There are so many cash back apps. Here are a few examples that I regularly use:

TopCashBack

I have a rule that I don’t buy anything online without using my own commission links from my travel partnerships, supporting another blogger, or getting cash back from sites like TopCashBack. I struggle so much getting friends/family to use my links when they are purchasing through one of my travel partners, so it’s no surprise to me that most people don’t use TopCashBack either.

I love shopping in person so last Christmas I enjoyed going through stores looking for gifts for my nephews. Then when I found what I wanted I ordered it online in the store and “went” and picked it up.

I know so many people who actually prefer online shopping. You have no excuse not to support a small business and earn a commission for them or at least earn TopCashBack for yourself!

Dosh

The Dosh app is so simple! It blows my mind why anyone wouldn’t want to use it. You can spend time looking up the offers and shopping accordingly, but you can also use it passively. Once you download it and link a card, you don’t have to do anything until it’s time to cash out!

Just the other day I dined at Park Tavern. When I got home I saw I had a notification that I earned 5% cash back. It isn’t a huge amount, but it all adds up. Did I mention it’s automatic too?

Fetch

I saw a friend taking a picture of their receipt from dinner the other night. I had to ask what they were doing. Sure enough they were using an app, the Fetch app.

There are several ways to earn points with this app. The easiest is by snapping a picture of your receipt from restaurants or any stores. You automatically receive at least 25 points, but depending on any bonuses you can receive much more.

I had a small pile of receipts on my counter. In only a few minutes of snapping pictures of all the receipts I earned over 1000 points!

Ibotta

I don’t find Ibotta quite as handy and worthwhile as the other cash-back options. The tracking isn’t as good for online shopping. Also it doesn’t work to link a card to receive automatic cash back.

I mostly use it for grocery shopping where I need to take a picture of my receipt and submit it afterwards. When I go to the store I have a very specific list based on what I want to eat in the next couple of days. I’m not always able to take advantage of the best deals. Ibotta would work the best for people in stationary homes that can stock up on goods based on the deals available.

Step 8: Redeem Your Miles/Points or Cash Back

Now that you have earned so many points and miles and received cash back on your purchases, it’s time to decide what to do with that money! Keep track of your accounts to make sure your points don’t expire and your cash back accounts stay active.

On most credit cards you can redeem your points for cash back, but that usually isn’t the best way to maximize your points. I will give you an example using some simple math. If you redeem 10,000 points for $100 cash back that’s at a rate of 1.0. Alternatively you could transfer those points to a travel partner that has a transfer bonus of 50% more points and have 15,000 points at Marriott. You could find a great deal for a hotel that costs $200 or 15,000 points at a rate of 1.3. You are receiving more per point!

Basically cash back is at a fixed rate, but when you redeem for hotels/flights it is variable, based on the offers you find. It pays to shop around a bit to find the best deal.

Bonus: Follow the Daily Drop

Overwhelmed? While I hope this guide on credit card travel hacking for beginners gave you some easy tips, there is a lot to learn about travel hacking! If you really want to earn a lot of points to redeem for big ticket stays and flights you’ll need a lot of strategy. It takes a while to learn. I continue to grow as a travel hacker as well.

The Daily Drop has been a huge help. The daily newsletter is full of all things travel, but focused on travel hacking. You’ll learn about the best credit cards, current travel promotions, and a whole range of hacks you didn’t even know existed.

The Daily Drop FB group offers live, free sessions on a variety of topics. If you are new, make sure to join a travel hacking 101 session. Plus the group is a place to connect with other travel hackers, ask questions, and learn from everyone.

If you learned anything about how to travel hack from this post, I hope it is that you need to use your credit card for every purchase and before you make that purchase make sure you are connected to any offers, loyalty programs, or cash-back apps.

If you have found this post helpful please consider supporting me by Buying Me a Coffee!

Pin IT!!

2 Comments

Janet Robinson

I found all of this very interesting. Of course I am familiar with the IHG program because I work at a hotel. My favorite story is of staying in a hotel for eight nights and didn’t pay for any of them. I like to say then I could afford to eat lobster instead of hot dogs. A lot of more I had not heard of but my son uses FETCH. I just didn’t know what he was doing. You have learned a lot in your travels. I enjoy your posts.

The Fearless Foreigner

Thanks for reading my posts! Earning 8 nights at a hotel is really impressive!! I have learned a lot about travel hacking, but there is always more to learn.